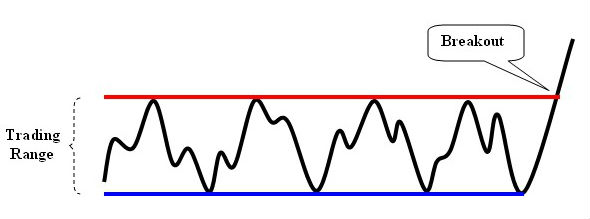

It is not unusual for markets that are either in the process of setting a long term top or bottom to confuse investors. A few weeks ago we indicated that it looks like gold is carving out a long term bottom. As we hit a major transition year politically, geopolitically, and financially, is should be no surprise that gold and silver prices are now confusing some gold traders.

This isn’t a major issue for those who have a three to five year horizon for holding their metals. In fact it is the best time to steadily accumulate gold and silver through disciplined dollar cost averaging, which has been proven as one of the best ways to buy gold and silver.

During times like this, it is important to stay focused on the reasons to buy gold and silver rather than the daily, weekly, and monthly price swings.

- Portfolio insurance

- Hedge against uncertainty

- Hedge against inflation pressures

- Its long term store of value

- Its long term role as money

Remembering these great reasons to own gold will help you avoid becoming confused even when the rest of the world does.